How to read your Notice

We've put together a sample to explain the information shown on your Rates and Charges Notice.

Find out more about the charges listed on your Notice below.

Rates

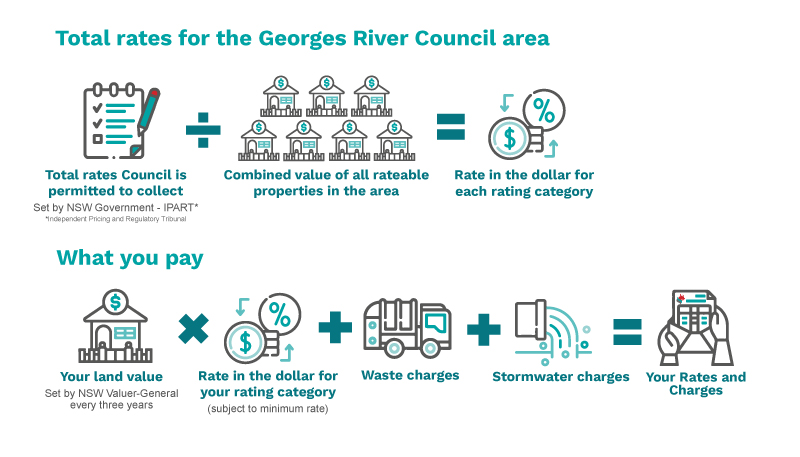

Your rates are calculated based on the land value of your property issued by the NSW Valuer-General, with low value properties subject to a minimum rate amount. This ensures each ratepayer contributes a fair share towards community services. The total amount of rates Council collects from ratepayers is limited (capped) by the NSW Government.

-

House owners generally pay much higher council rates than strata properties like apartments, villas or townhouse), due to their higher land value.

-

Apartment/villa/townhouse owners are either charged the minimum rate or the rate based on their share of the complex, whichever is higher. (Each strata lot has units of entitlement that determine its share of the total land value).

Service Charges (waste and stormwater)

Waste disposal costs usually rise each year, but improvements in the new collection contract have lowered Council’s expenses - resulting in reduced waste management fees for 2025/26. Stormwater charges remain the same.

You can view our video on how rates are calculated or click on the video below.

Overview - Our Area

-

Estimated residential population: 161,593(per Australian Bureau of Statistics).

-

Georges River rates per person (total residential rates collected ÷ population): $497.00 (in 2025).

-

New South Wales' average rates person: $591.00 (in 2019).

-

Other states average: $835.00 (in 2019).

Rate and Charges Structure for 2025/2026

|

Type

|

Minimum

|

Rate in the dollar*

(Ad-valorem)

|

| ^Residential - Ordinary |

$1,104 |

$0.0013177 |

| ^Business General - Ordinary |

$1,257 |

$0.0029958 |

| ^Business Industrial - Ordinary |

$1,257 |

$0.003679 |

| ^Business Local - Ordinary |

$1,257 |

$0.0040391 |

| ^Business Major Shopping Complex - Ordinary |

$1,257 |

$0.012676 |

| ^Business Strategic Centres - Ordinary |

$1,714 |

$0.0041911 |

| Domestic Waste Standard Service Charge |

$600 |

| Stormwater Management Charge |

Residential property:

- Non-strata $25

- Strata $12.50

Non-residential property:

- Non-strata $25 for every 350 square metres or part thereof to a maximum of $1,500 per rateable property.

- Strata not less than $5 for any individual lot.

|

*Applicable to land values issued by NSW Valuer-General.

^Rating category. For more information, visit Council's Land Values and Rating Categories page.

Your rates and charges working for you

Rates are re-invested back into the community for vital services that benefit the whole community. These services include:

Understanding Rates and Charges - Frequently Asked Questions

For information on waste services, visit Council's Waste page.

For more information, please refer to the Office of Local Government Frequently Asked Questions page.

Thank you for your feedback.